Credit cards have changed how we handle money and pay for things. They come with many credit card benefits.

Credit cards let you “buy now, pay later.” This means you can shop without needing cash right away. This flexibility makes them a powerful financial tool when used correctly.

Credit cards offer more than just payments. They provide rewards programs, security benefits, expense tracking, and financial backup in emergencies.

They also play a crucial role in building a strong credit history, which can unlock better financial opportunities in the future.

In this guide, we’ll explore how credit cards work. We’ll cover their short- and long-term benefits, plus tips for using them responsibly.In this guide, we’ll explore how credit cards work. We’ll cover their short- and long-term benefits, plus tips for using them responsibly.

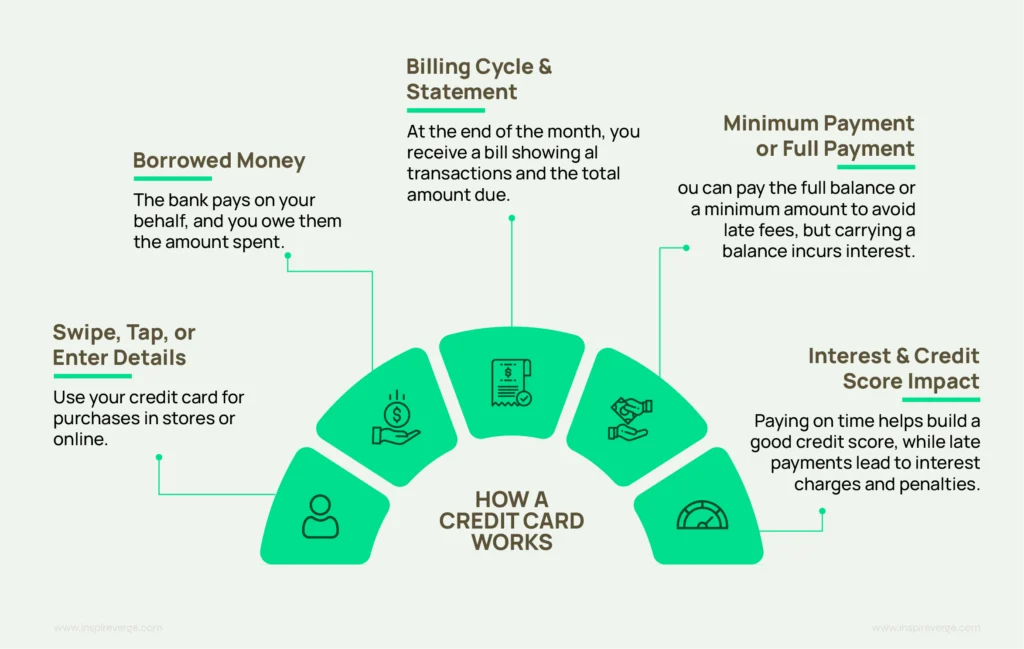

How Credit Cards Work

A credit card is essentially a short-term loan that a bank or financial institution provides to a user. Every time you swipe or tap your card for a purchase, the bank covers the payment on your behalf. At the end of the billing cycle (usually a month), you receive a statement detailing your expenses and the total amount due.

You have two options:

- Pay the full balance – This ensures you avoid any interest charges and maintain a strong credit profile.

- Pay the minimum amount due – This prevents late payment fees but results in interest charges on the remaining balance.

Most credit cards have a grace period. This period usually lasts 30 to 50 days. During this time, you can make purchases without paying interest. But remember to pay your bill before the due date.

Many credit cards offer customizable spending limits, EMI options, and expense tracking. These features make them great for budgeting and financial planning. They really enhance the benefits of using a credit card.

Short-Term Credit Cards Benefits

1. Convenience and Ease of Use

One of the biggest benefits of credit cards is the ease of payments anytime and anywhere. You can use them for online shopping, dining out, booking flights, or paying bills. A credit card means you don’t need to carry cash.

Unlike debit cards, credit cards offer flexibility in payments. This is helpful for managing cash flow, especially if you are waiting for your salary or a payment.

2. Enhanced Security and Fraud Protection

Credit cards are much safer than cash or debit cards. If you lose cash, it’s lost for good. But if your credit card is lost or stolen, you can block it right away using your bank’s app or by calling customer service.

Many credit cards offer zero-liability protection. This means you won’t be responsible for unauthorized transactions if you report the loss quickly.

Other security features include:

- Fraud monitoring systems detect unusual spending patterns and alert you about suspicious transactions.

- Virtual credit cards give you a temporary card number for safer online shopping.

- Multi-layer authentication boosts security for online purchases. It uses methods like OTP (one-time password) and biometric verification.

These protections make credit cards safe and reliable for payments, especially online. They enhance the overall benefits of using credit cards.

3. Rewards and Cashback Programs

One key benefit of credit cards is their reward programs and cashback offers. Each time you use your card, you can earn:

- Reward points – Collect points for discounts, shopping vouchers, flight tickets, or cashback.

- Cashback offers – Receive a percentage of your spending back in your account.

- Exclusive discounts – Enjoy savings on dining, travel, and entertainment.

Some credit cards offer higher rewards for specific spending categories. For instance, if you often eat out, you can pick a card with extra cashback on restaurant bills. If you travel a lot, you may want a card with airport lounge access. It could also offer travel insurance and discounts on flight tickets. These features add value to your credit card benefits.

By choosing a card that matches your spending habits, you can boost your savings. You’ll also enjoy various benefits and extra perks on daily purchases.

4. Expense Tracking and Budgeting

Managing expenses is easier with a credit card. Every transaction shows up on your monthly statement. With cash, you might forget your spending, but credit cards offer a detailed history. They also provide categorized spending reports and real-time tracking through mobile banking apps.

Many banks also provide spending analysis tools, allowing you to:

- Set monthly spending limits for different categories (e.g., groceries, fuel, entertainment).

- Receive alerts when you exceed your budget in a particular category.

- Track how much you spend on essential vs. non-essential items.

These features can help you improve financial discipline, make the most of your credit card benefits, and avoid overspending.

5. Interest-Free Period for Smart Spending

Credit cards offer an interest-free period (usually 30 to 50 days) during which you can use the credit without paying any extra charges—as long as you clear the full balance before the due date.

This feature allows you to manage cash flow more efficiently. For example, if you need to make an urgent purchase but don’t have immediate funds, you can use your credit card and pay it off once you receive your salary—without incurring any interest.

Additionally, many credit cards allow you to convert large purchases into EMIs (Equated Monthly Installments), making it easier to afford expensive items like electronics, home appliances, or furniture while enjoying various credit card benefits.

6. Travel Benefits and Global Acceptance

Credit cards, especially those issued by Visa and Mastercard, are widely accepted worldwide, making them an excellent choice for frequent travelers. Carrying cash in foreign countries can be risky, and debit cards may not always work internationally. Credit cards solve this problem by offering:

- Seamless currency conversion at competitive exchange rates.

- Airport lounge access, providing a comfortable waiting experience.

- Travel insurance coverage for flight cancellations, baggage loss, or medical emergencies abroad.

Some premium credit cards also offer frequent flyer miles, hotel discounts, and rental car insurance, making travel more affordable and hassle-free while providing valuable credit card benefits.

Long-Term Credit Card Benefits

1. Building and Improving Your Credit Score

A credit score is one of the most important factors that determine your financial credibility. It affects your ability to get loans, rent a house, or even secure a job in some cases.

Using a credit card responsibly is one of the best ways to build a strong credit score. Making payments on time and maintaining a low balance shows lenders that you are a reliable borrower, which can help you enjoy various credit card benefits.

- Get approved for home loans, car loans, and personal loans at lower interest rates.

- Increase your credit limit, giving you more financial flexibility.

- Improve your chances of getting approved for premium credit cards with better rewards.

2. Emergency Fund and Financial Backup

Life is unpredictable. Unexpected expenses can pop up anytime. Whether it’s a medical emergency, home repairs, or a car breakdown, a credit card gives you quick access to funds. This way, you avoid the stress of borrowing from friends or family. Instant financial support can be a lifesaver when cash isn’t available.

A great credit card benefit is covering emergency expenses easily. Use your card for urgent medical care, emergency hotel stays, or last-minute travel. Don’t wait for payday or take out a costly loan. Many credit cards allow cash advances, so you can withdraw cash in emergencies. Be careful with this option, as cash advances usually have higher interest rates.

Credit cards offer more than emergency funds. Many include various insurance coverages for unexpected events. Some cards offer buy protection. This feature keeps your valuable items safe from theft or damage right after you buy them. Others extend the manufacturer’s warranty on electronics, saving you money on repairs. Some cards offer travel insurance for travelers. This insurance covers lost baggage, cancellations, flight delays, and medical emergencies overseas. These protections boost credit card benefits. They help keep you financially secure, no matter what happens.

A credit card also proves handy when traditional banking services are limited. If you’re in a foreign country and need help, a global credit card can assist. You can use it to book a hotel, rent a car, or buy essentials quickly. Some premium cards offer concierge services. They can assist with emergency travel plans. They can also find medical facilities or make quick reservations.

Although credit cards provide a great safety net, using them wisely is crucial. Pay off your balance on time and keep your credit use low. This way, you can enjoy these credit card benefits without falling into debt.

Good and Bad of Having a Credit Card

A credit card helps you buy things even if you don’t have money right now. You can pay later, but if you don’t pay on time, you must pay extra as interest. Some people spend too much and struggle to pay back. Missing payments can hurt your credit score, making it harder to get loans. Some credit cards also have fees. But credit cards can be useful. They help in emergencies, allow big purchases in small monthly payments (EMIs), and give rewards or cashback. If used wisely, a credit card can save money and make life easier.

Without a Credit Card – Good or Bad?

Without a credit card, you only spend what you have, so you avoid debt and extra fees. It helps you manage money better. But it also has downsides. You may not be able to book hotels, rent cars, or buy expensive things in EMIs. You also miss out on rewards. Most importantly, you won’t build a credit score, which is needed for loans in the future. Not having a credit card keeps you safe from debt, but it can limit your financial options.

Final Thoughts

Credit cards are a powerful financial tool. They offer rewards, convenience, and security. However, use them responsibly. Pay your bills on time, control your spending, and pick a card that suits your lifestyle. This way, you can maximize benefits and avoid debt.

A credit card, when used wisely, can save you money and help you build wealth. It can also guide you toward financial success over time. Plus, you’ll enjoy valuable credit card benefits.