A credit card can be a useful tool when handled carefully, but misuse can lead to debt and financial trouble. Many people don’t fully understand how to use a credit card effectively, which can result in fees and stress. This guide explains the most important things to remember when using a credit card, so you can make smart choices and avoid problems.

Know Your Credit Limit

Your credit limit is the maximum amount you can borrow on your credit card. Banks or companies set this limit based on your credit score and income. It’s important not to use all of your credit limit because it can hurt your credit score and lead to financial problems. A good rule is to use less than 30% of your limit. For example, if your credit limit is $1,000, try not to borrow more than $300 at a time. This helps you stay in control and avoid extra fees.

Pay Your Bill On Time

Paying your credit card bill on time is one of the most important things you can do. If you don’t, the bank will charge you interest and late fees. Late payments also hurt your credit score, making it harder to borrow money in the future. To avoid forgetting, you can set up reminders on your phone or use automatic payments through your bank. Try to pay your bill before the due date every month to avoid extra costs.

Avoid Late Payments:

- Set phone reminders or use automatic payments to pay on time.

- Pay early to avoid forgetting.

- Track your due dates to stay organized.

If You Miss a Payment:

- You’ll pay interest and late fees.

- Your credit score will drop if the payment is 30 days late.

- Some cards raise your interest to 30% as a penalty.

Pay More Than the Minimum Payment

Credit cards allow you to pay a “minimum payment” each month. This is a small part of what you owe. However, if you only pay the minimum, you will still owe money, and interest will keep adding up. Paying just the minimum can make it take a long time to pay off your balance. It’s best to pay the full amount if you can, or at least pay more than the minimum. This helps you avoid getting stuck in debt.

- Round Up Your Payments: Instead of paying just the minimum, round up the amount. For example, if the minimum is $35, pay $50 or $100 if you can. This reduces your balance faster.

- Pay Multiple Times a Month: If you get paid weekly or biweekly, make smaller payments each time you receive money. This lowers your balance and reduces interest.

- Use a Budget: Make a budget to see how much you can pay toward your credit card every month. Set aside more than the minimum amount.

- Avoid New Purchases: While paying down your balance, avoid making new charges so you don’t add more debt.

- Target High-Interest Debt First: If you have multiple cards, pay more on the one with the highest interest rate first to save money on interest.

Understand Interest Rates

Interest is extra money the bank charges you if you don’t pay your bill in full. Each credit card has an interest rate, shown as a percentage. If you don’t pay off the full balance every month, the interest will make your debt grow faster. For example, if your card has a 20% interest rate, every month you’ll have to pay 20% more on whatever is left unpaid. Always check your credit card’s interest rate and try to avoid carrying a balance to avoid paying extra.

Here are some tips to manage interest:

- Check Your Interest Rate: Always know your card’s interest rate before using it. Higher rates mean more debt if you don’t pay in full.

- Pay the Full Balance Monthly: Avoid interest charges by paying off your balance completely each month.

- Understand APR (Annual Percentage Rate): APR includes both interest and fees, giving a clearer idea of how much borrowing on the card costs.

- Use a 0% APR Card: Some cards offer 0% APR for a limited time. Use this to pay off big purchases without interest but pay before the offer ends.

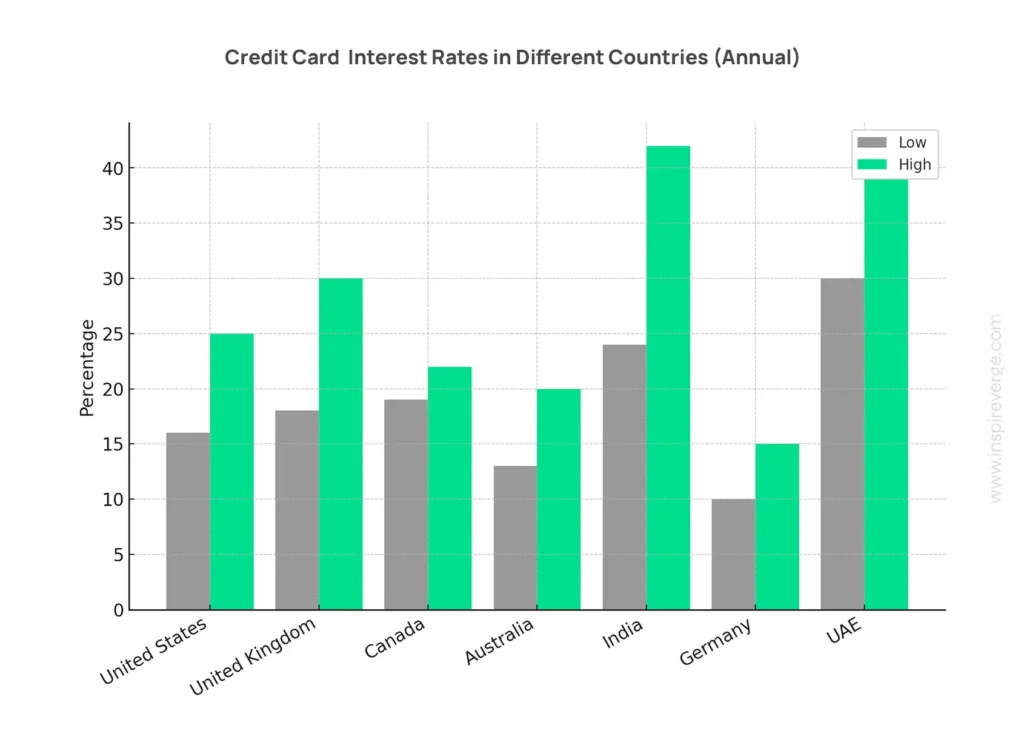

Here are average credit card interest rates in different countries (Annual):

- United States: 16% to 25%

- United Kingdom: 18% to 30%

- Canada: 19% to 22%

- Australia: 13% to 20%

- India: 24% to 42%

- Germany: 10% to 15%

- UAE: 30% to 39%

Use Credit Cards for Budgeting

Credit cards can be useful for budgeting because they help you track your spending. Every month, you get a statement showing everything you bought with your credit card. This can help you understand where your money is going. You can use your credit card statement to make a budget and see where you can save money. Just be sure not to spend more than you can afford to pay back.

Helpful Uses:

- Track Spending: Use your credit card statement to see where you spend the most. This can highlight areas where you might cut back.

- Rewards and Cash Back: Many cards offer rewards points or cash back on purchases. Use these rewards to save money or for future purchases.

- Automatic Payments: Set up automatic payments for bills like subscriptions. This ensures you never miss a payment and can help in budgeting for those regular expenses.

- Emergency Purchases: A credit card can be useful for unexpected expenses, like car repairs or medical bills, allowing you to pay them off over time if needed.

Negative Uses:

- Overspending: It’s easy to spend more than you can afford when using a credit card. Always stick to your budget to avoid debt.

- Impulse Purchases: Having a credit card may tempt you to buy things you don’t need. Avoid making purchases on a whim.

- High Interest Debt: If you carry a balance, the interest can add up quickly, making it harder to pay off your debt.

- Neglecting Other Bills: Relying too much on credit cards might lead you to forget about other necessary expenses, like rent or groceries.

Earn Rewards and Cash Back

Many credit cards offer rewards, points, or cash back for spending money. For example, you might earn points for buying groceries, gas, or even online shopping. Over time, you can use these points to get discounts or free items. Some credit cards also offer cash back, which means the card gives you a small percentage of your spending back in cash. While rewards are nice, it’s important to remember not to spend extra just to earn points. Only buy what you need and can afford.

Tricks to Earn Extra Rewards Without Spending Too Much:

- Use Your Card for Regular Expenses: Pay for everyday purchases like groceries, gas, or utility bills with your credit card. This allows you to earn rewards on things you’d buy anyway.

- Take Advantage of Bonus Categories: Many cards have special bonus categories that earn extra points or cash back in certain months. Keep track of these and plan your spending around them.

- Use Rewards for Online Purchases: Shop through your credit card’s rewards portal when buying online. This often gives you extra points or cash back on your purchases.

- Pay Off Bills with Your Card: If your landlord or utility provider allows it, pay your rent or bills with your credit card. Just ensure you can pay the balance off to avoid interest.

- Refer Friends or Family: Some credit cards offer rewards for referring new users. If you have friends or family who are looking for a credit card, refer them to earn bonus points.

- Combine Rewards with Sales: Look for sales or discounts at stores where you earn rewards. This way, you save money and earn points at the same time.

- Join Loyalty Programs: Many stores have loyalty programs that can be linked to your credit card. This allows you to earn rewards from both the store and your card.

Avoid Cash Advances

A cash advance is when you use your credit card to take out cash from an ATM. It sounds helpful, but cash advances come with high fees and higher interest rates than regular purchases. Plus, interest on cash advances starts right away, which means you will owe extra money immediately. It’s best to avoid using your credit card for cash advances unless you have an emergency and no other options.

Here are some key points to remember about cash advances:

- High Fees: Cash advance fees typically range from 3% to 5% of the amount you withdraw. Some cards may have a minimum fee, often around $10, regardless of the percentage.

- Higher Interest Rates: Cash advances usually have higher interest rates than regular purchases, often between 20% and 30%. This means you’ll pay more interest on cash advances compared to your normal credit card spending.

- Immediate Interest Accrual: Unlike regular purchases, where you might have a grace period, interest on cash advances starts accruing immediately. This means you’ll owe extra money right away.

Keep Your Card Information Safe

It’s important to keep your credit card information safe. Don’t share your card number or PIN with anyone you don’t trust. When shopping online, only enter your card details on secure websites. Secure websites usually have “https” at the beginning of the web address and a lock symbol. If someone steals your credit card information, they could use it to buy things in your name, and you could be responsible for the charges. If your card gets lost or stolen, contact your bank immediately to stop unauthorized charges.

Check Your Statements Regularly

Every month, your credit card provider sends you a statement showing what you spent, fees, and payments. It’s very important to check your statement carefully to make sure all the charges are correct. Sometimes mistakes happen, or someone might use your card without permission. If you see something wrong on your statement, contact your bank right away. Regularly checking your statement also helps you stay on top of your budget and control your spending.

Build Good Credit History

Using a credit card responsibly can help you build a good credit history. Your credit history shows how well you handle borrowing money and paying it back. Lenders, like banks or loan companies, use your credit history to decide if they should give you a loan or credit. A good credit score can help you get lower interest rates and better loan terms. To build good credit, always pay your bill on time, don’t use all of your credit limit, and avoid carrying a balance.

Don’t Open Too Many Credit Cards

Having too many credit cards can be risky. Each time you apply for a credit card, it affects your credit score. Also, managing multiple credit cards can be difficult, especially when it comes to making payments on time. It’s best to stick to one or two credit cards that fit your needs. Having fewer cards makes it easier to track your spending and avoid getting into debt.

Know the Fees

Credit cards can have different types of fees, like annual fees, late payment fees, and foreign transaction fees. Some cards charge you just for having the card, which is called an annual fee. Other cards charge you extra if you pay late or use your card in another country. Before choosing a credit card, make sure you know all the fees it charges. If possible, look for cards with no annual fees or low fees to save money.

Conclusion

Using a credit card effectively can help you manage your finances, earn rewards, and build a good credit score. Always stay within your credit limit, pay your bill on time, and avoid carrying a balance to avoid interest. By being smart with your credit card, you can avoid debt and use your card as a helpful financial tool.

How to Get Out of Debt and Stay Debt Free, A Step-by-Step Guide